Concerns about a £52 million drop in the value of Orkney council’s pension fund were raised in the council chamber this week.

However, the pensions sub-committee were told that there was no need to panic and that markets go up and down.

The annual report and accounts for the council’s pension pot for 2021/2022 were presented to councillors at a meeting this morning.

The local authority’s head of finance, Erik Knight, said there had been a loss but “the markets are a long game”.

Having spoken to one of the council’s fund managers, Baillie Gifford, he said they were “bullish about the long-term prospects” for the council’s investments.

Mr Knight added: “They identified that the markets do have dips. We have to sit it out and markets will come back.”

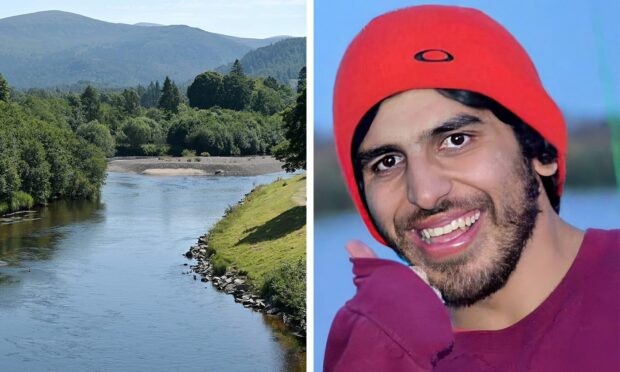

However, Councillor Lindsay Hall was left concerned over the decline in the value of the fund.

While the sub-committee was told the fund had decreased from £520m to £508m over the year, it had in fact peaked at £561m in December 2021.

Councillor said: “It’s easy to say that these things are quite bullish, but your £508m which is reduced from £520m in March 2021. That may look like £12m but if it was up to £560m then it’s dropped by over £52m.

“That’s a considerable drop.”

Councillor Hall expresses concern over decline in pension fund value

He asked: “Is that really cause for complacency or should we be thinking about adjusting where we have the money?”

Mr Knight replied that he didn’t feel the council is complacent with its investments.

He said the council’s strategy is “fairly robust” and will safeguard the assets it holds.

He said: “As much as the market has fallen in that time, so have the share prices in the investments we’re making. So we’re actually investing in shares now, which have a lower premium.”

Mr Knight said that when the markets bounce back the pension fund should see a greater return.

He added: “If you look back at the Covid 2020 year, the market gave us a fairly big dent.

“We had a bit of a loss to start with. A year later it bounced back.

“The figures we were shown last year were very good. The market does that – it goes up and down.”

Mr Knight said the investment portfolios held by the council aim to strengthen holdings in digital and renewables companies and funds which offer a return which will safeguard the assets of the pension fund.

Councillor Hall wasn’t totally satisfied, saying a fall from £560m to £508 didn’t seem proportionate to a “market fluctuation”.

He said: “Obviously, it built up considerably since Covid, because it had built up from £520 to £560. It seems to me to be not so much a wave as a definite peak and trough.”

The councillor wondered if there was any evidence for optimism, in how the council is being advised on the fund.

Orkney council pension fund saw strong return in investment during Covid but Ukraine war has taken its toll

David Walker, chief investments officer with fund actuary Hymans Robertson was at the meeting and replied.

He said long-term returns were important to make sure benefits are sustainable and affordable.

He also said the rises and falls in the funds value, pointed out by councillor Hall aren’t totally unexpected.

Mr Walker said: “In our modelling, we assumed that the volatility within equity markets could be plus or minus 20%.

“So, in one year out of three, you could see a 20% rise or fall. So for a £500m fund that could be £100m in terms of the size and magnitude of that move.

The pension fund saw a strong period through Covid, with investments in technology doing well.

However, this has been offset by events in Ukraine. Also, a “higher inflationary environment tending to punish technology stocks” has taken its toll, Mr Walker said.

Conversation