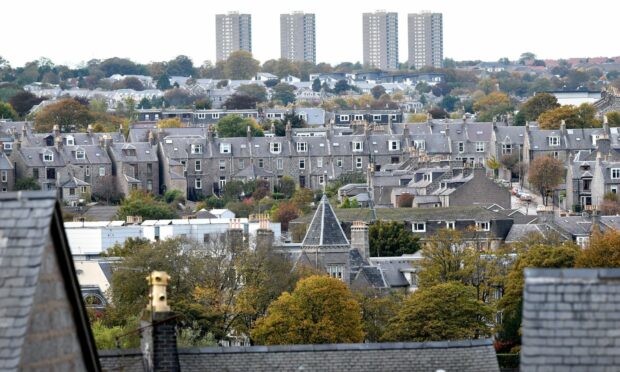

It doesn’t seem that long ago that both first time buyers and home movers were reasonably relaxed about what they would be paying for their mortgage.

Indeed rates had remained fairly stable and at very low levels for some years.

Then the conflict in Ukraine arrived and things got a little less relaxed. Not only did rates begin to rise, albeit slowly, but the general cost of living also began to increase.

And just when you thought the worst might have hit us, along came the new prime minister and her chancellor with their mini-Budget. Not what the doctor ordered.

‘Damaging impact’

Some people have described it as disastrous and by any measure it certainly had a damaging impact on the UK economy, especially interest rates. The knock-on effect of the following few months has been felt by the whole country and most definitely by people either looking to buy a home for the first time, or looking to move or renew their mortgage deal.

We have since seen interest rates rise at a rapid pace, with base rate predictions of well over 6% and nearing 7%.

Mortgage rates have risen accordingly, making it significantly more difficult for anyone whose mortgage deal is coming to an end and putting off those who may be first time buyers.

Given the difficulties over the past few months, you could be forgiven for wondering if or when the pain will end. Well, perhaps there may be – just may be – some light at the end of the tunnel.

Firstly, the predictions of ever increasing base rates have resided somewhat. And, secondly, inflation seems to be falling – perhaps not as quickly as we’d like but it is falling.

Finally, and most importantly for home buyers and those with a mortgage, a number of major lenders have begun to reduce their rates. Halifax, HSBC, Nationwide, NatWest, Virgin Money and TSB are among those who have recently cut their mortgage rates.

Again, it is not by as much as we might like but it is still enough to make a difference.

Now, the big question is will we see a return to the era of ultra-low mortgage rates?

Is a new normal for mortgages coming?

The consensus opinion appears to be “no”. In fact, many experts believe rates of around 1% or so were probably the exception and that their normal level looks more like 4-5%.

That said, if you can now base your affordability on those higher figures, then at the very least any fall in rates can be seen more as a bonus than a necessary requirement.

So, is this a good time to get a mortgage or buy a home?

As ever, it depends on your individual circumstances but the best place to start is speaking to a mortgage broker.

Darren Polson is head of mortgage operations at Aberdeen-based law firm Aberdein Considine.

Conversation