Christmas is the season for giving, but when it comes to planning your family’s financial future December shouldn’t be the only time it’s on your mind.

If you want to offer financial support to your family, annual gift allowances mean you can pass on money among your family members free from inheritance tax.

The annual exemption allows you to gift £3,000 every year, or £6,000 per couple, tax-free to one or more people.

And you can carry forward any unused allowance to the next tax year. You will have to use the current year’s allowance first.

Much to consider when looking at annual gift allowances

Making the most of gift allowances can allow you to help your family now and reduce the overall value of your estate for inheritance tax purposes. But, as with most things relating to your finances, there is much to consider.

You may want to think about making small regular gifts to help with family budgeting and building financial resilience.

You can make regular payments of any amount to help your child or someone else with their living costs tax-free, but you must be able to show you can afford these payments from your surplus income.

It’s important you don’t compromise your own standard of living, or go without certain things in order to make regular payments.

If you are able to make regular gifts, these are classed as “normal expenditure out of income”.

If you want to make a gift that isn’t covered by any of these exemptions, you can still do so. It will be considered a “potentially exempt transfer” (Pet).

A Pet will be subject to inheritance tax if you die within seven years of giving the gift and your estate exceeds the nil-rate band.

The nil-rate band is £325,000 per person and includes all types of assets you may own.

There is also a £175,000 residence nil-rate band you can use if you’re passing on your home to direct descendants.

Your estate will only be liable to inheritance tax if the total value of your assets exceeds these thresholds.

If you die within seven years of giving a Pet gift, it will be counted as part of your estate and use part or all of your nil-rate band. Gifts above the nil-rate band made between three and seven years before your death are taxed on a sliding scale, known as “taper relief”.

Keep a record of everything

Always keep a record of any gift you make and when you made it. It will save your executors time and potentially tax when they come to sort out your finances.

Another reason you may want to consider gifting is the way modern life has changed inheritance.

In the past, wealth was passed down from generation to generation.

Now, people are living longer and their descendents may not receive an inheritance until much later in life.

St James’s Place’s recent survey confirms this. More and more parents want to help their children now, rather than making them wait for the inheritance.

Nearly one-third (31%) of our clients thought it was more important to support their children during their lifetime than leave a legacy, although the latter was still very desirable.

People see it as doing the right thing by your family. Money is moving up and down the generations, whether it’s helping children through a difficult patch between jobs or getting someone in to help yelderly parents with the gardening.

Gifting, legacy planning and tax awareness should all be part of a family-wide conversation.”

Financial advice is there to help you find the most tax-efficient way to achieve this, while making sure you’re not damaging your own financial capability.

Gifting, legacy planning and tax awareness should all be part of a family-wide conversation. Starting to plan finances as a family can help build a brighter financial future for every generation.

Passing wealth onto our loved ones is one of the final acts of love we’re able to make.

Putting the right plans in place at an early stage will mean there is greater opportunity to build wealth over time.

It will also allow you to leave behind as much as possible when you’re gone without making unnecessary sacrifices along the way.

If you’d like to talk to us about using your wealth to help your family, just get in touch.

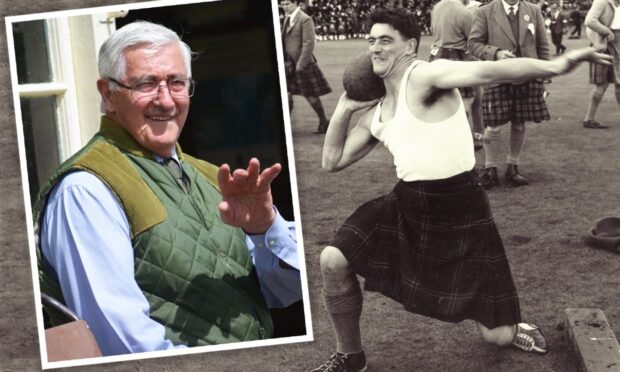

Gary Walker is the founder and managing director of Aberdeen firm Gary Walker Wealth Management, a principal partner practice of St James’s Place.

Conversation