Virgin Money is upping the pace of a digital strategy that has left some rural parts of the north and north-east bereft of a local branch of the bank.

The group – which includes the former Clydesdale Bank network in Scotland – is investing £275 million in a three-year drive to accelerate growth, including through an “efficiency-focused digital strategy”.

Part of this “digital-first” approach will see customers offered a virtual “wallet” to easily access Virgin’s wide range of products and services.

We’ve made significant strategic progress to transform Virgin Money into a leading digital bank.”

David Duffy, chief executive, Virgin Money.

The digital wallet is expected to be available during the second half of 2022.

According to Virgin, it will feature a “seamless and secure” payment mechanism, while also allowing users to both earn and spend points through the bank’s Virgin Red loyalty scheme.

This and other measures to accelerate digital banking are expected to save Virgin around £175m by the end of its 20023-24 trading year, with about half of this being either reinvested in the business or used to absorb the impact of inflation.

Big jump in profits

In an unscheduled trading update earlier today (November 4), Virgin said it expected underlying pre-tax profits for the year to September 30 2021 to rocket by 546% to £801m, from £124m in 2019-20, driven by “strong financial momentum” and

an improved macroeconomic outlook.

Gary Greenwood, investment analyst at Shore Capital Stockbrokers, said: “The results themselves show profit to be comfortably ahead of consensus, primarily due to a larger than expected provision releases, while capital is stronger than expected and the group has also recommenced dividends with a modest final payment proposed.

“However, updated guidance indicates significant investment in the coming years which may weigh on statutory profit forecasts in the near-term, given further sizeable restructuring charges.

“As a result, management now expects it will take until FY24 for the group to achieve a sustainable double-digit RoTE (return on equity), which we think is likely to disappoint investors.”

Mr Greenwood added: “The group appears to have backed away from previous cost reduction targets in favour of investing in the business.”

‘Compelling value’

Announcing the digital wallet plans, Virgin chief executive David Duffy said: “By fully integrating the Virgin Red rewards club alongside our broader suite of products and services, we can create compelling value for both customers and the

bank.”

And in the group’s surprise interim update, Mr Duffy said: “Virgin Money had a strong first half.

“We doubled underlying profit compared to last year and returned to statutory profit.

“The quality of our loan book remained resilient in the period, and we’ve continued to support customers and look after our colleagues and communities, while

safeguarding the bank.

“We’ve made significant strategic progress to transform Virgin Money into a leading digital bank and our rebranding is largely complete.

“We’ve launched a range of innovative and compelling Virgin Money personal and business products as well as differentiated loyalty offers, which are showing early signs of success.”

He added: “We are cautiously optimistic about the improving outlook as the impact of the vaccination programme in the UK delivers positive revisions to economic expectations.

‘Sustainable returns’ – but closures too

“We’re continuing to manage through what is still an uncertain economic backdrop, but the bank is well-placed, with a strong balance sheet, and through ongoing strategic delivery we have a clear path to long-term, improved sustainable returns.”

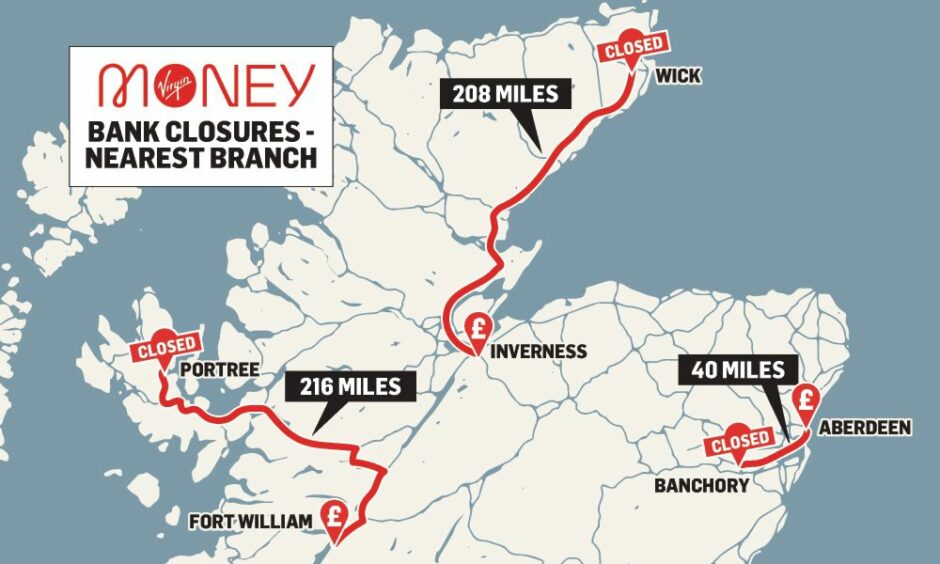

In September, Virgin announced it was shutting 12 of its branches in Scotland.

Sites in Banchory, Wick and Portree are among those earmarked for closure early next year.

Virgin said it was the result of fewer customers using the branches but insisted the “tough decision” was “not taken lightly”.

Customers in Portree are facing a round trip of up to 216 miles to their next nearest branch in Fort William.

It is a similar story for customers in Wick, with their nearest branches either a 208-mile round trip to Inverness, or 76-mile journey via boat to Kirkwall in Orkney.

Customers in Banchory face a 40-mile round-trip to their next nearest branch in Aberdeen.