Demand is growing for buy-to-let properties across the north and north-east as investors seek to capitalise on good rental returns and the rising property market.

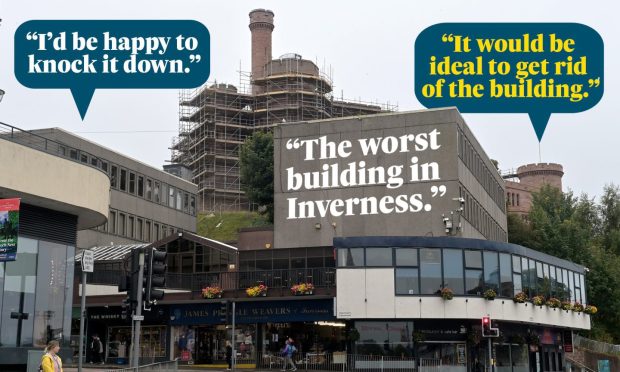

Local estate agent Galbraith has reported a boom in the buy-to-let market with a typical two-bedroom apartment in Inverness expected to sell for £165,000 with a prospective landlord achieving rent of between £750 to £775 per month.

Marsaili Macleod, a lettings adviser with Galbraith, says there are two key reasons why there has been a shift in the market.

Strong demand from tenants

“In recent years investors have been more interested in the holiday lets sector as these were often considered a more profitable option than residential lets,” said Marsaili.

“Now we are talking to more landlords who are interested in the core residential lets market for two reasons.

“Firstly, strong demand from tenants and lack of supply means that rental prices are rising and the landlord can pick and choose from waiting tenants.

“Secondly the value of the property itself will rise over the term of ownership because property prices have risen considerably in Scotland over the past two years.

“Many of our clients are planning ahead and investing in a buy-to-let property which will achieve good capital growth and fulfil their financial objectives while offering security.”

Lenders are currently offering capital and interest mortgages, or interest-only mortgages, for buy-to-let properties with monthly repayments lower than the likely monthly rental fee.

According to Marsaili, this offers the potential to achieve a return each month even taking into account that a purchase of this kind is subject to the Land and Buildings Transaction Tax at 4 per cent on second homes.

And with the cost of borrowing remaining low, Marsaili also believes that this is playing a part in the market change as people are using it as an opportunity to invest in their future.

Low borrowing costs

“Although interest rates are rising, the cost of borrowing remains historically low,” said Marsaili.

“The potential returns in the buy-to-let sector are good, coupled with the likely significant rise in value of the property itself over the term of ownership.

“Clients are considering whether to buy a property which can be let now to a tenant and in five or 10 years’ time potentially made available to their children as a first home or for when they go to university.

“Having evaluated the returns from the holiday lets sector and the potential returns from residential tenancies, clients are choosing the residential lets market.”

Galbraith currently lets over 1,000 homes to residential tenants for clients across Scotland and the north of England.

For more information about this phone Galbraith on 01224 860710 or check out the website www.galbraithgroup.com