New figures reveal that the average price for a property in the Highlands has reached record levels.

The report, issued by the chartered surveyor company Walker Steele Fraser, shows that the average price for a home in the region jumped by over £26,000 from £203,007 in August last year to £229,055 in August this year – a 12.8 % increase.

And despite recording a smaller number of property sales – 21 sales in August this year – the average price for a home on the Shetland Islands rose by a massive 19.6% over the year.

Bucking the national Scottish trend – where the average price for a home in Scotland decreased slightly by 0.1% between July and August this year – five other north and north-east regions – Aberdeenshire, Aberdeen City, Orkney Islands, Moray and Na h-Eileanan Siar – also recorded property price hikes.

The north and north-east breakdown

In Aberdeenshire, the average property price in August this year was £235,718 which represents a 3.6% increase from August last year where the average price paid for a home was £227,544.

Meanwhile, the Orkney Islands saw a 12.2% rise in the average property price – from £186,108 in August 2021 to £208,878 in August this year – while house prices in Moray increased by 14% from £180,355 in August 2021 to £205, 545 in August this year.

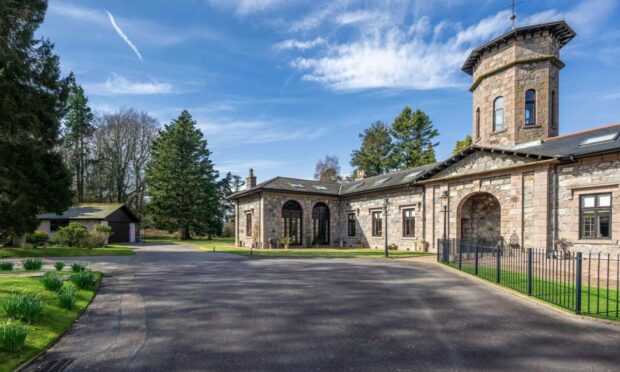

A boom in people looking for larger properties to accommodate working from home – largely priced over £750,000 – could be one of the reasons fuelling the price increases, according to Scott Jack, the regional development director at Walker Fraser Steele.

“What this number of sales over £750k tells us is that ‘working from home’ and the ‘race for space’ continue to be important features of the current housing market, even if the prominence of the Covid restrictions are beginning to wane,” says Mr Jack.

“Properties of this nature command more space to accommodate new ways of living but remain in short supply which again supports the average house price – even in the face of some meaningful economic headwinds thanks to global inflationary pressures.”

The figures show that between January and August this year, 15 houses in Aberdeen were sold over the £750,000 price tag with the highest sale recorded as £1.05m in March.

In Aberdeenshire, 11 houses were sold over £750k with the highest sale recorded as £1.10m in March.

Meanwhile, nine houses in the Highlands sold for over £750k, three houses in Moray and one in Na h-Eileanan Siar.

Aberdeen

But in comparison to Scotland’s eight cities, Aberdeen recorded the second-lowest average property price at £198,755 while Edinburgh recorded the highest at £339,302 and Dundee recorded the lowest at £174,121.

With so much economic turmoil at the moment, Mr Jack says property prices may be affected.

“How resilient prices are over the coming months remains to be seen,” says Mr Jack.

“Certainly, some of the recent domestically inspired spikes to mortgage affordability may yet dampen buyer enthusiasm, but the interventions from the new chancellor are designed to stabilise the cost of borrowing – and there remains a shortage of desirable property.”

House prices in Scotland: Track the property values in your area

Conversation